IEA (2020), Implementing Effective Emissions Trading Systems, IEA, Paris https://www.iea.org/reports/implementing-effective-emissions-trading-systems, Licence: CC BY 4.0

ETS in industry

Facilitating low-carbon transitions in industry through emissions trading systems

As in the power sector, a carbon price applied to the industry sector would ideally reach both producers and consumers of industrial products. In theory, producers would perceive the carbon price through the increased cost of carbon-intensive inputs and processes. This would encourage them to switch to lower-carbon production processes and to invest in carbon-intensity reduction technologies. Consumers would be affected by higher final costs for carbon-intensive industrial products and would be encouraged to purchase less carbon-intensive alternatives. In practice, however, several barriers can prevent these effects from happening.

This section provides an overview of the main issues that jurisdictions often have to address when trying to reduce emissions from industry via an emissions trading system. These include addressing industry competitiveness and carbon leakage concerns, phasing out transitional assistance and free allocation in favour of auctioning.

Emissions trading systems and industry: Context and objectives

How the industrial sector is included in an emissions trading system needs careful consideration. On one hand, policy makers should estimate the greenhouse gas mitigation potential available in industry and reflect on the role of their industry within the wider decarbonisation of the economy. On the other hand, introducing an emissions trading system in the industrial sector may affect some companies’ international economic competitiveness. Therefore, it is important to estimate the potential economic impact that an emissions trading system would have on the various players in the sector.

The introduction of an emissions trading system would also occur within a context of other companion policies affecting the stakeholders in the industry. Examples of companion policies in industry are air pollution control regulations, industrial energy conservation programmes, environmental taxation, and other policies for long-term economic restructuring and ecological industrial development.

Carbon pricing can play a key role in emissions reduction from industry, given that operational and investment decisions are highly cost-sensitive. In the medium term, a carbon price can make energy efficiency improvements at scale more cost-effective, and in the longer term it can be a key incentive for investments in innovative technologies, such as carbon capture, utilisation and storage, and electrolytic hydrogen (e.g. in the steel sector).

Competitiveness and carbon leakage concerns for industry

Bringing industry into an emissions trading system that also covers the power sector can raise near-term competitiveness concerns. It can also create socio-economic concerns if investments in industry fall and jobs are lost. And environmental concerns arise from carbon leakage, the potential displacement of industrial production (and associated pollution) to jurisdictions with less stringent environmental controls or emissions reductions requirements. All current emissions trading systems are attempting to prevent the carbon price from lowering the competitiveness of specific sectors or the entire economy of the jurisdiction by including features aimed at reducing the extra costs that an emissions trading system can bring for some industries.

The importance of the identification of industries with highest risks of carbon leakage

Different emissions trading systems have faced the same concerns on the application of a carbon price to similar types of industries. These include emissions-intensive industries, which could face higher costs to reduce emissions, and trade-exposed industries, which could lose competitive economic advantage and face carbon leakage. The industrial sectors and products often deemed at risk of carbon leakage include cement, aluminium, iron and steel, paper, refineries and chemicals. It is important to identify specifically which industries could be the most affected by carbon pricing, as well as their trade exposure.

The EU ETS, for example, determines which industries are at risk based on the impact of production costs as a proportion of gross value added, and trade exposure as the ratio between the value of trade to countries outside the European Economic Area (EEA) (exports and imports) and market size within the EEA.

These calculations would ideally include both direct and indirect costs. Direct costs refer to the costs of implementing mitigation measures and acquiring allowances. Indirect costs refer to an increase in the price of other products covered by the emissions trading system, which in industry often refers to increases in the cost of electricity and heat. The indirect costs imposed on industry will vary according to their carbon intensity and other structural factors. In practice, the regulatory framework of the electricity market and the contractual arrangements between industry and electricity suppliers will also affect indirect costs.

Other costs related to the introduction of an emissions trading system can also affect competitiveness. These can include: investment risks if there is uncertainty associated with emissions trading system policy design; changing market share as the value of low-carbon products and services increases compared with high-carbon ones; and compliance costs, such as measurement, reporting and verification. One-off fees and payments may also be required to cover the administrative costs of developing and implementing an emissions trading system.

Free allowance allocation as a response to industry competitiveness concerns

The distribution (allocation) of emission allowances among the industrial entities covered in an emissions trading system determines how the burden of meeting the target is shared across the sector. Allowances can be allocated for free or put up for sale at auctions.

If an emissions trading system auctioned all the allowances, this would impose costs on industry, potentially impacting competitiveness, which might result in industrial production losses in certain sectors at a level that would be economically damaging. Therefore, most emissions trading systems aim to reduce one of the key direct costs by providing free allowances to industries considered at risk of carbon leakage. Free allowance allocation has also proved to be more politically and economically feasible than other options, such as financial compensation, exemption from the emissions trading system or border carbon adjustments.

In this context, most emissions trading systems allocate a significant share of free allowances to industrial sectors considered at risk of carbon leakage and the remaining allowances are put up to auction. The EU ETS also includes a financial compensation approach, whereby member states can compensate industries that face significant indirect cost increases due to their electricity intensity.

There are two main methods of free allowance allocation in emissions trading systems:

- Grandfathering: Free allowances can be provided to industries based on their historical emissions over a specified period. If historic data is available, this approach is straightforward. This approach was used in the EU Emissions Trading System’s first pilot phase. Grandfathering, however, is often regarded as rewarding the status quo rather than better performers and could penalise “early movers” who invested in emissions reduction measures at earlier stages.

- Benchmarking: Most emissions trading systems have moved towards allocating free allowances on a “benchmark” basis. The “benchmarking” approach provides free allowance allocation to companies that perform below a set level of emissions, e.g. emissions per unit of product or emissions intensity. This approach encourages and rewards early action and higher environmental performance. Benchmarking requires an understanding of complex industrial processes as well as a high level of data availability. Different benchmark methodologies would give a different benchmarking level for a given industry. For example, the benchmark could be set at the “best achieved level”, or “best available” level, average of top X% performers in the industry, average level or a hybrid model (e.g. average level of the X and Y percentile). The level at which the benchmark is set is important for the industrial stakeholders covered by the emissions trading system, as this would determine the amount of allowances that the facility would receive and would impact its compliance obligations. The benchmarking level is also affected by and depends on other factors, including technical assumptions in the calculations and where the industrial facility emission boundaries are set. Therefore, the benchmarking methodology chosen can have a significant impact on the obligations of the industries covered by the emissions trading system.

Examples of free allowance allocation application to industry

In its first phase (2015-17), Korea’s emissions trading system granted 100% free allocation using a mixed approach of grandfathering and benchmarking. The benchmarking approach was applied only to three sectors (grey clinker cement, oil refineries and domestic aviation) due to the limited availability of historic data. In Phase 2 (2018-20), 97% of allowances were freely allocated, with around 50% of these being allocated with a benchmarking approach. The remaining 3% of allowances were auctioned. The benchmarks for domestic aviation, grey cement clinker and oil refining are set at the weighted average emission intensity level of entities covered by the emissions trading system.

Korea’s emissions trading system was implemented in an environment of extreme competitiveness concerns and strong opposition from industry due to a perceived initial under-allocation of allowances. Some industrial companies sued the government on the basis that non-compliance penalties were too high and because of limitations on the use of carbon offsets for obligations compliance with obligations under the emissions trading system. To manage these concerns, the government auctioned the reserve allowances and established stability mechanisms, such as more flexible banking rules, price control mechanisms and generally greater flexibility for industry (e.g. increasing ability to borrow allowances). The result of these trade-offs is a less clear and less predictable policy signal, which could lead to delayed investment in greenhouse gas abatement measures.

The EU emissions trading system also followed a phased approach with regard to allocation. In Phase 1 (2005-07), allowances were allocated through grandfathering, with a mix of auctioning and benchmark allocation varying among member states. In Phase 2 (2008-12), 90% of allowances were grandfathered, still using a mixed approach between benchmarking (the overwhelming majority) and auctioning. In Phase 3 (2013-20), 43% of allowances were allocated through the benchmark approach and 57% via auctions. For the industrial sector in particular, free allowance has followed a benchmark approach, setting the benchmark level at the average emissions of each sub-sector’s 10% best-performing facilities since 2013. Industries considered at risk of carbon leakage receive free allocation at 100% up to a predetermined benchmark. The gradual shift towards stricter benchmarking since 2013 lowered over-allocation of free allowances and mitigated carbon leakage risks.1

In the European Union, free allocation may be updated annually in Phase 4 (2021-30) in the case of sustained changes in production, i.e. if the industrial annual output changes by more than 15% compared with the average baseline of the two previous years. In times of economic crisis, such as the 2009 financial crisis or the one induced by the Covid-19 pandemic at the beginning of 2020, industry activity levels generally fall drastically, which could lead to a significant reduction of the level of free allowance allocation under current EU Emissions Trading System rules. Therefore, some industries argue that keeping the crisis year (e.g. 2020) outputs as part of the benchmark calculation for free allowance allocation would distort the results and could further hinder their competitiveness.2 The EU ETS will review its rules in 2021 to address these concerns.

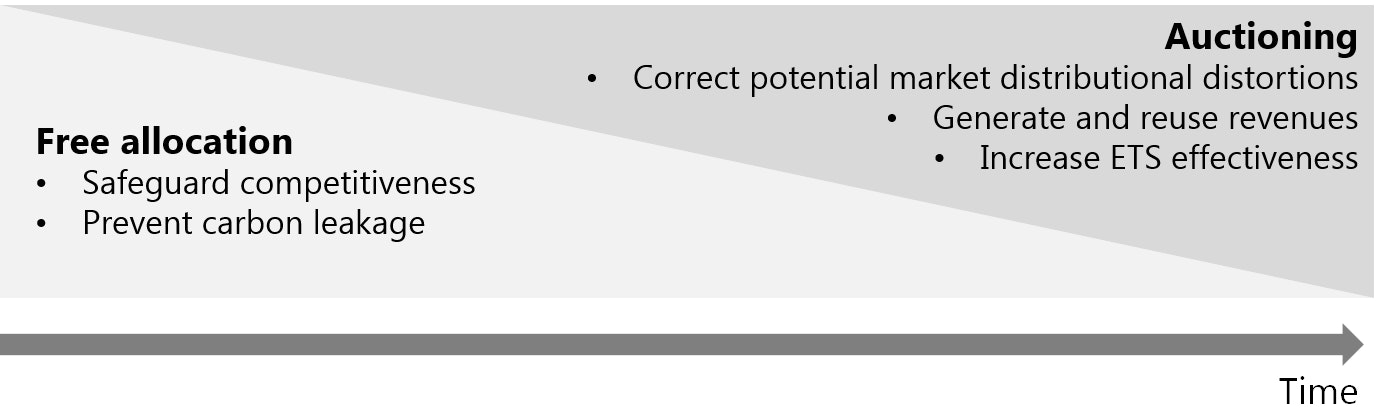

Phasing down free allocation as transitional assistance over time in favour of allowance auctioning

Emissions trading systems that address competitiveness and carbon leakage concerns through free allowance allocation often gradually phase down free allowance allocation in favour of auctioning, for three main reasons:

- Correcting potential market distributional distortions: Free allowance allocations act as a subsidy, reducing costs only for those who receive free allowances, at the expense of those who do not and who bear more costs (e.g. consumers or industries ineligible for free allowances). Providing free allocation only to certain types of industries can also have regional impacts, depending on the geographical distribution of industries within a country. If this is uneven, costs may not be evenly spread, potentially complicating burden-sharing arrangements across subnational jurisdictions. Reducing free allocation can help address distributional distortions. These include effects such as windfall profits, whereby industries that receive free allowances pass carbon costs entirely through to consumers (e.g. due to international trade exposure), thus realising additional profit.

- Generating and reusing revenues from auctioning: Allowance auctioning creates revenues for the government. These can be used to invest in further climate mitigation action or to address distributional impacts, such as providing compensation for low-income households. Allocating some allowances for free reduces the amount of allowances destined for auction, which in turns reduces the potential auction revenues that could be spent on further climate mitigation action. In California’s cap-and-trade system, 85% of the revenues from electricity sector allowance auctions are used to ultimately offset customer cost increases. Of these revenues, 3% are to be used to help industry become more efficient, for example through utility rebates or incentives that benefit industrial energy efficiency investments, and therefore reduce the effect of electricity cost increases on industry. In the EU ETS, at least 50% of revenues from allowance auctions are used to support climate and energy activities, both domestically and internationally. Most member countries use these revenues to invest in domestic climate and energy measures, including renewable energy, energy efficiency and sustainable transport, and to compensate energy-intensive companies for increased energy costs resulting from the emissions trading system. A part of these revenues is also channelled to the Innovation Fund, one of the instruments designed to help the European Union reach its target under the Paris Agreement.

- Free allocation can lower the emissions reduction effectiveness of emissions trading systems: In theory, the allocation method should not affect the effectiveness of the emissions trading system in reducing emissions. In practice, under intensity-based caps, receiving 100% of allowances for free effectively provides no incentive to reduce emissions. Free allowances can also weaken incentives to invest in less carbon-intensive technologies, lowering the overall efficiency of the system. This could have consequences beyond the timeline of the trading system if high-carbon assets are locked in.

Phasing down free allocation as transitional assistance over time in favour of allowance auctioning

Open

Allocating free allowances to trade-exposed industry assumes that these industries would struggle to pass carbon costs through to final product prices because of the competitive nature of international trading markets. In the EU ETS, at current carbon prices trade-exposed industries, including cement, iron and steel, and oil refineries, have passed through the costs of allowances to varying rates, creating windfall profits. Phase 3 allocation rules are likely to have limited the risk of windfall profits by reducing free allocation overall, including auctioning the overwhelming majority of allowances in the power sector and shifting towards benchmark allocation. The experience from the EU ETS shows that interactions between benchmark design and pass-through of carbon (opportunity) costs need careful consideration and need to be followed over time as carbon prices varies. Overall, while free allocation reduces costs to industry, it is unclear how it affects competitiveness and carbon leakage, both in the short and long term.

Key lessons

- Potential competitiveness and carbon leakage impacts on industry stemming from the implementation of an emissions trading system should be examined closely. Efforts to ease such impacts should focus on industries that may be truly at risk of carbon leakage.

- Free allowance allocation has been widely used by various emissions trading systems as a way to address competitiveness and carbon leakage concerns for the industrial sector. There exist different design methodologies to allow free allocation of allowances, which require varying degrees of inputs. The choice of the allocation method is important for industries covered by the emissions trading system, as this would determine the amount of allowances that the facility would receive and would affect its obligations under the system.

- Gradually phasing down free allocation in favour of auctioning can help correct potential market distributional distortions, create the possibility of generating and reusing revenues from auctioning, and increase the emissions trading system’s emissions reductions effectiveness.

Guiding questions for policy makers

- How can the impact of competitiveness and risks of carbon leakage be accurately identified for different industries? Are data available for authorities to understand the carbon intensity, the possible abatement options, trade exposure and cost pass-through ability of different industries? Are data accessible to gauge impacts of the emissions trading system on these industries? If not, how can these data be collected and monitored?

- How can allocation decisions balance concerns about near-term competitiveness with the need to ensuring cost efficiency and distributional equity? Is free allocation to industry necessary to address industry competitiveness and carbon leakage concerns? If so, how can free allocation be gradually phased down?

- In which industries are sufficient data available to develop benchmarks? Which alternative methods of determining allowance allocation will be needed where necessary data are not available across all industries?

References

Sartor O., C. Pallière and S. Lecourt (2014), Benchmark-based allocations in EU ETS Phase 3: An early assessment.

Carbon Pulse (2020), Analysis: EU industry seeks to safeguard flow of free carbon units as virus impact skews.

Sartor O., C. Pallière and S. Lecourt (2014), Benchmark-based allocations in EU ETS Phase 3: An early assessment.

Carbon Pulse (2020), Analysis: EU industry seeks to safeguard flow of free carbon units as virus impact skews.